Return on Investment (ROI) is a performance metric used to assess the profitability or efficiency of an investment relative to its cost. It is commonly expressed as a percentage, calculated by dividing the net profit from an investment by the initial investment cost.

This involves:

- Measuring the financial gain or loss

- Comparing costs to benefits

- Analyzing performance over time or against alternatives

Purpose and Applications

ROI serves as a simple and universal tool for evaluating the success of an investment. Businesses use ROI to determine whether a project, campaign, or purchase delivers sufficient value. For example, companies calculate ROI to assess marketing campaigns, product launches, or capital investments.

Why is ROI Important?

ROI is crucial as it provides clear insights into an investment’s effectiveness, helping businesses make data-driven decisions. It enables the comparison of multiple opportunities, ensures resource allocation aligns with strategic goals, and ultimately contributes to sustainable growth and profitability.

Streamline Your Tech Stack to Boost Profitability

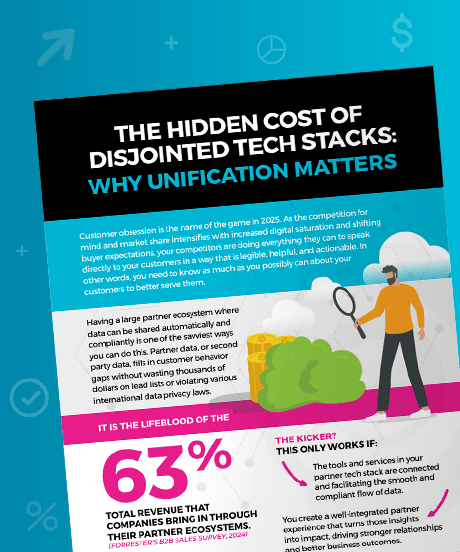

Infographic

The Hidden Cost of Disjointed Tech Stacks: Why Unification Matters

The solution lies in a unified strategy that brings all systems, tools, and services together into one sleek, integrated tech stack.

Learn how to streamline your businesses tech infrastructure, to optimize your margins.