Co-Investments are funding arrangements where multiple parties, typically institutional investors or high-net-worth individuals, collectively invest alongside a lead investor in a specific project, deal, or asset.

This often occurs in private equity or real estate ventures and includes:

- Sharing investment capital among participating parties

- Aligning with the terms and strategies of the lead investor

- Conducting due diligence collaboratively or relying on the lead investor’s expertise

Co-investments allow participants to access larger, high-quality opportunities while minimizing their overall risk exposure. These arrangements often provide investors with direct participation in specific investments, reduced fees compared to traditional fund structures, and greater control or insight into the underlying assets.

Co-investments are particularly beneficial for fostering strategic partnerships, diversifying investment portfolios, and maximizing potential returns by leveraging pooled expertise and resources.

Streamline Your Tech Stack to Boost Profitability

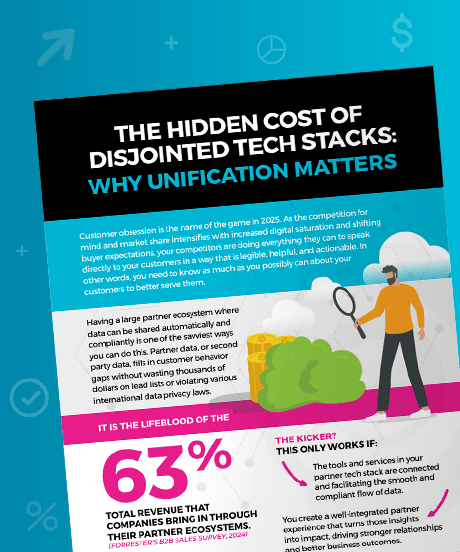

Infographic

The Hidden Cost of Disjointed Tech Stacks: Why Unification Matters

The solution lies in a unified strategy that brings all systems, tools, and services together into one sleek, integrated tech stack.

Learn how to streamline your businesses tech infrastructure, to optimize your margins.